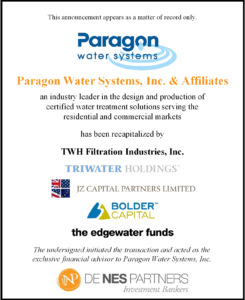

ATLANTA, GA – Atlanta-based investment banking firm De NES Partners, LLC is pleased to announce the recapitalization of its client Paragon Water Systems, Inc. (“Paragon”) by Triwater Holdings, LLC. Headquartered in Tampa, Florida, and led by George Lutich and David Swain, Paragon is a leading, global provider of water treatment solutions to a broad range of customers in the residential and commercial segments. With manufacturing operations in the U.S. and China, Paragon conceptualizes, designs, certifies for regulatory compliance, and manufactures a comprehensive line of water filtration products, both original equipment and aftermarket. Paragon has established a strong reputation for product development and quality and is the supplier of choice for leading, global OEM clients, including major retailers, dealers, and direct selling channels.

Triwater Holdings, LLC is an Illinois-based company focused on a broad range of water treatment solutions. Paragon represents Triwater’s first investment in the residential and light commercial water filtration solutions segment. Backed by Bolder Capital, Triwater is led by water industry veteran Michael Reardon, founding executive of U.S. Filter, which Mr. Reardon helped build into a Fortune 300 company.

Doug Hubert and Don Schaeffer, who co-founded De NES Partners in January 2014 after many years leading the investment banking practice for CBIZ, Inc., commented, “George Lutich, CEO, and David Swain, President, have led Paragon on an aggressive, organic growth path in recent years as a number of long-term product development projects have come to fruition. George and David expressed their need for additional capital and strategic resources to ensure continued growth and outlined to us what they wanted in the right partner and transaction. With its water industry experience, deep contacts and financial backing, Triwater fit the profile perfectly, and our client could not be more pleased. We anticipate a strong partnership going forward.”

De NES Partners focuses on representing owners of single and multi-generational family and other privately-held businesses across the United States with revenue between $15-250 million and EBITDA between $3-30 million in M&A (full sale and recapitalization) transactions. The firm’s two principals, with nearly a combined 45 years of mergers & acquisitions advisory experience, have successfully completed transactions across the full spectrum of manufacturing, distribution, and company-to-company business services, and have sold clients to some of the most sophisticated buyers in the world, including companies listed on the NYSE, NASDAQ, Toronto, Irish, and London Stock Exchanges, as well as numerous institutional private equity firms.

Messrs. Hubert & Schaeffer are registered representatives of, and Securities Products and Investment Banking Services are offered through, BA Securities, LLC. Member FINRA SIPC. De NES Partners is a separate and unaffiliated entity from BA Securities, LLC.

For more information about the Paragon Water transaction, please contact Don Schaeffer, Managing Partner, De NES Partners, LLC, (770) 858-4493, dschaeffer@deNESpartners.com.